richmond property tax rate 2021

26 2021 The city of Richmond has approved its tax rate and budget for the Fiscal Year 2022. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

Fillable Online Business Tangible Personal Property Tax Return City Of Richmond Fax Email Print Pdffiller

Tax District 003 Hephzibah 290790.

. What is the due date of real estate taxes in the City of Richmond. Tax District 001 Urban 339240. Car Tax Credit -PPTR.

What is the real estate tax rate for 2021. 2021 Net Millage Rates are as follows. 2021 Richmond Millage Rates To view previous years Millage Rates for the City of Richmond please click here.

Region of York - 50 per cent of property taxes. Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Ad Find Out the Market Value of Any Property and Past Sale Prices.

The Fiscal Year 2021 Tax rates are. Vehicle License Tax Vehicles. Yearly median tax in Richmond City.

What is considered real property. 2021 Property Tax Value 1679 2021 Residential Property Tax Rate 0335744 2021 Tax rates for Cities Near Richmond Download Chart as Compare 400 Agents Experiences Commissions ONLY ON WOWAca Richmond Property Taxes If you own or lease property or mobile homes in BC you will be subject to paying property tax annually. Year Municipal Rate Educational Rate Final Tax Rate.

Real estate taxes are due on January 14th and June 14th each year. 19-20 Commitment Book Map and Lot 19-20 Personal Property by Name. This year the city chose to select the compensating rate for the 2021 rates.

Residential Property Tax Rate for Richmond Hill from 2018 to 2021. Richmond City has one of the highest median property taxes in the United States and is. Tax District 002 County wfire 310460.

Real Property residential and commercial and Personal Property. Learn about Richmond Hills budget. Craig Moseley Houston Chronicle Staff photographer Ahead of the fiscal year with starts Oct.

These documents are provided in Adobe Acrobat PDF format for printing. Tax District 004 Blythe wfire 323780. Personal Property Taxes are billed once a year with a December 5 th due date.

Over 4M 4 1000 of assessment value over 4M 0004 City of Richmond 2021 TAX RATES New Additional School Tax for Qualifying Residential Properties. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. The residential tax bill is divided as follows.

20-21 RE Tax Bills 20-21 PP Tax Bills. How are residential property taxes divided. Twenty-six counties had a revaluation in 2019 and 12 counties have one in 2020.

Richmond Hill accounts for only about a quarter of your tax bill. Between 3M to 4M. Tax Rate 2062 - 100 assessment.

School Boards - 23 per cent of property taxes. 19-20 Tax Bills Personal Property 19-20 Tax Bills Real Estate G-O. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead.

Property taxes are billed in October of each year but they do not. 105 of home value. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

Whether you are already a resident or just considering moving to New Richmond to live or invest in real estate estimate local property tax rates and learn how real estate tax works. 19-20 Tax Bills Real Estate A-F 19-20 Tax Bills Real Estate P-Z. Property Tax The tax rate for FY 2021-2022 is 380000 cents per 100 assessed value.

Vehicle License Tax Motorcycles. The average property tax rate is now 6760 compared to 6785 last year a 035 decrease statewide. Learn all about New Richmond real estate tax.

Vehicle License Tax Antique. Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February 28th. Richmond Hill - 27 per cent of property taxes.

The rates will be adjusted for 163 cents on each 100 of personal property and 134 cents on each 100 worth of real. Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph. 07297 Municipal Includes Conservation Reserve Fund.

The real estate tax rate is 120 per 100 of the properties assessed value. 2 1000 of assmt value between 3M to 4M 0002 Tier 2. 19-20 Commitment Book Name 19-20 Personal Property by Account.

Fifteen counties had a tax rate change in 2020-21 with four counties increasing and eleven counties decreasing their rate. Macomb County Homestead Tax Rate Comparisons. Personal Property Registration Form.

11 Things To Know Before Moving To Richmond Va

Richmond Hill Property Tax 2021 Calculator Rates Wowa Ca

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

Tax Sale Lists Richmond County Tax Commissioners Ga

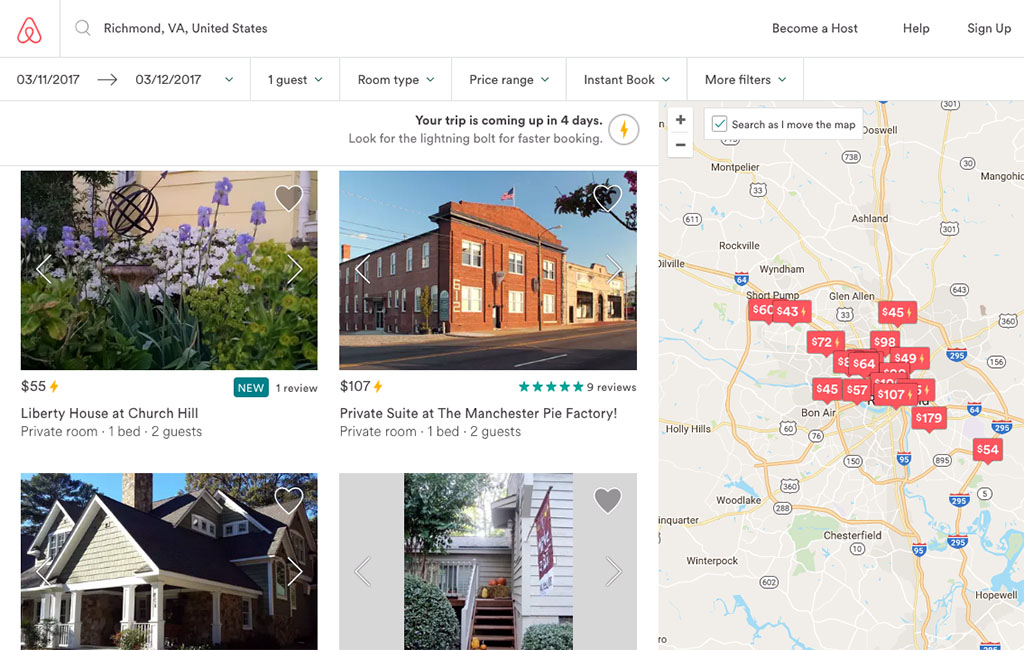

Richmond Delays Revisiting Airbnb Style Home Rental Rules Until January Richmond Bizsense

Millage Rates Richmond County Tax Commissioners Ga

These 6 Ontario Cities Currently Have The Lowest Property Tax Rates In The Province In 2021 Ontario City The Province City

Realtor Now Is The Time To Look For Homes To Buy In Richmond

What Is The Property Tax Rate In Richmond Tx Cubetoronto Com

6111 Sunrise Drive Ne Fridley Mn 55432 Mls 5713966 Themlsonline Com In 2021 Fridley Home Mortgage Construction Loans

Taxes Greater Richmond Partnership Virginia Usa

Richmond Ky Taxes Incentives Richmond Industrial Development Corporation

Residential Services City Of Richmond

1213 Laureate Turn Richmond Va 23236 Realtor Com

Richmond Marketbeats United States Cushman Wakefield

Richmond Va Metro Area June 2021 Real Estate Market Update In 2021 Real Estate Marketing Real Estate First Home Buyer

Formerly Redlined Areas Of Richmond Are Going Green Chesapeake Bay Foundation